Can I Make A 2025 Roth Contribution In 2025. This limit was lower in 2025 at $6,500. For 2025, you could contribute up to $6,500 ($7,000 in 2025) a year to your roth individual retirement account (ira) or $7,500 ($8,000 in 2025).

But there are income limits that restrict who can contribute. Depending on your magi, filing status, and earned income, you may be able to make the federal maximum contribution to your roth ira ($6,500 for those under 50;

Savings Account vs. Roth IRA What’s the Difference?, You can make 2025 ira contributions until the. Roth ira contribution limits for 2025.

:max_bytes(150000):strip_icc()/savingsvs.ira_V1-b63b805de8554f589543be193cad9857.png)

2025 Charitable Contribution Limits Irs Linea Petunia, You can make 2025 ira contributions until the. Your roth ira contribution might be limited based on your filing status and income.

What Is The Ira Contribution Limit For 2025 2025 JWG, For people age 50 or older, the contribution limit is $8,000. For 2025, the roth ira’s contribution limit is $7,000.

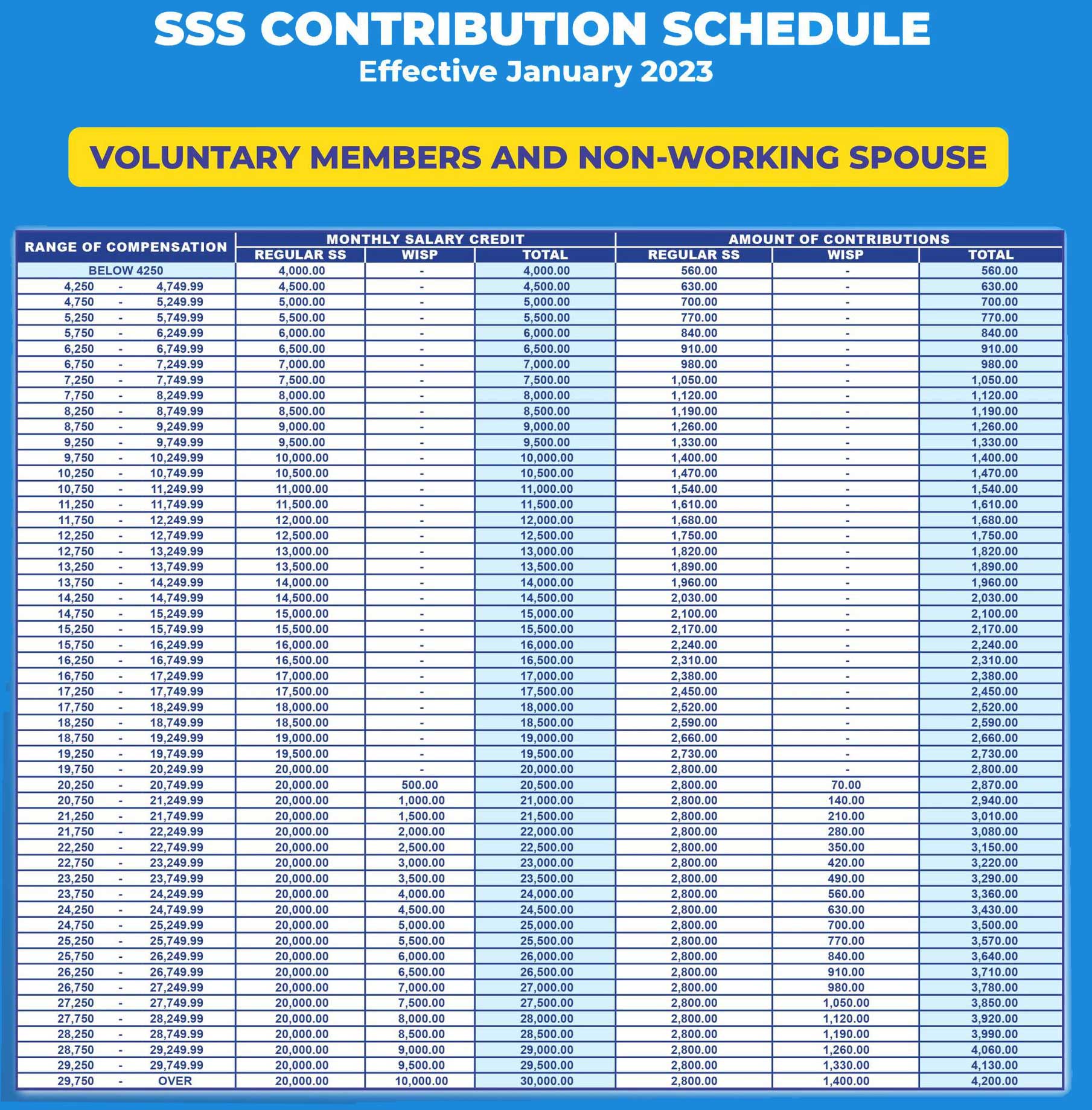

SSS Voluntary Members Contribution Table 2025, You can make a partial contribution if you have an agi of between $116,000 and $136,000 in 2025, which goes up to between $123,000 and $143,000 in 2025. The roth ira contribution limit increases from $6,500 in 2025 to $7,000 in 2025.

Retirement Planning Inflation Protection, This table shows whether your contribution to a roth ira is affected by the amount of your modified agi as computed for roth ira purpose. You can make a partial contribution if you have an agi of between $116,000 and $136,000 in 2025, which goes up to between $123,000 and $143,000 in 2025.

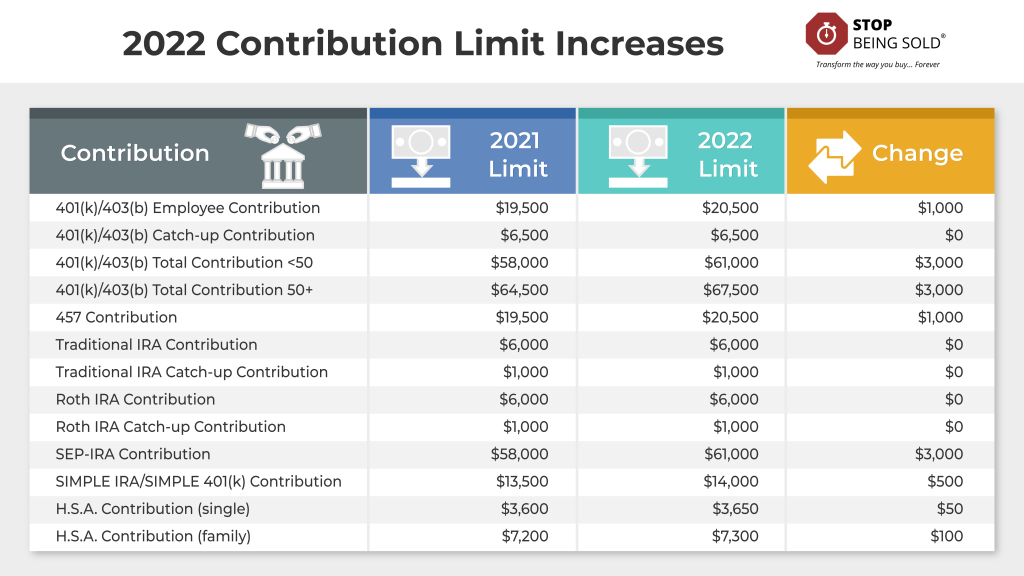

2025 Retirement Plan Contribution Limits Stop Being Sold, You can make a partial contribution if you have an agi of between $116,000 and $136,000 in 2025, which goes up to between $123,000 and $143,000 in 2025. Roth ira contribution limits for 2025.

401k Catch Up Contribution Limits 2025 Over 50 Kenna Alameda, The roth ira contribution limit for 2025 is $7,000 for those under 50, and an additional $1,000 catch up contribution for those 50. The contribution limit for a roth ira is $6,500 (or $7,500 if you are over 50) in 2025.

New SSS Contribution Table 2025, If you have a roth 401(k) plan and a roth ira, your total annual contribution across all accounts in 2025 cannot exceed $29,000 ($30,000 in 2025), or $37,500. These figures have increased for the 2025 tax year, though.

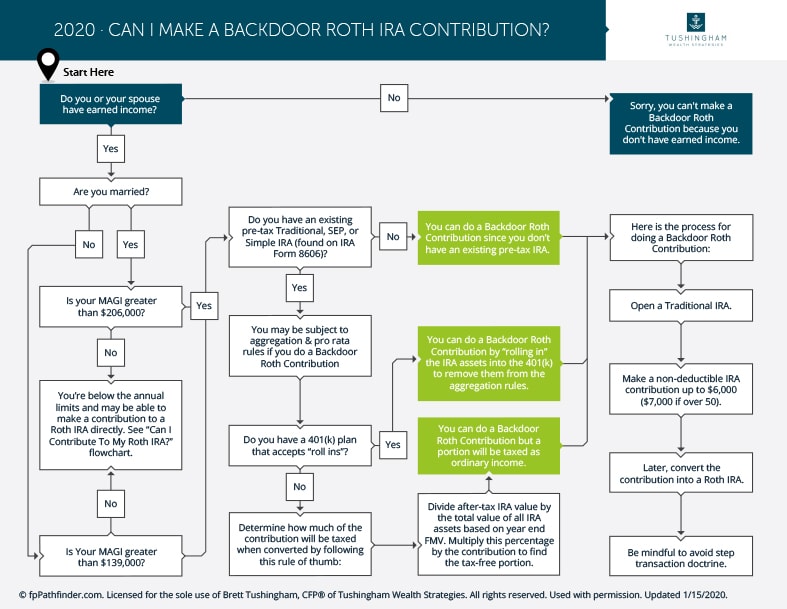

Physicians Financial Planning Checklist Tushingham, You can’t make a roth ira contribution if your modified agi is $240,000 or more. This table shows whether your contribution to a roth ira is affected by the amount of your modified agi as computed for roth ira purpose.

2025 Roth Contribution Max Agata Ariella, You can make 2025 ira contributions until the. 12 rows the maximum total annual contribution for all your iras combined is:

Depending on your magi, filing status, and earned income, you may be able to make the federal maximum contribution to your roth ira ($6,500 for those under 50;